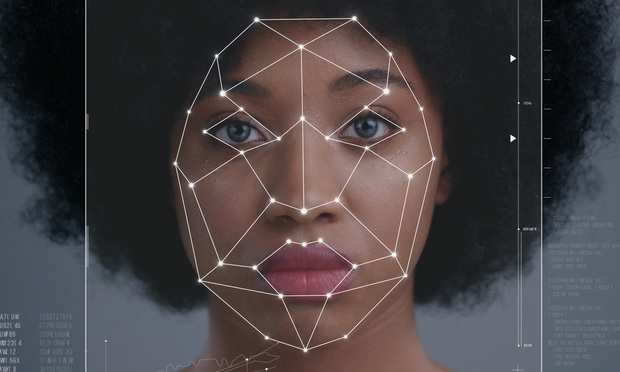

Clearview AI Inc., which uses facial recognition to provide photographic information, is facing litigation in Illinois and New York for violating data privacy laws.

According to Law.com, “Clearview AI Inc., which uses facial recognition to provide photographic information, primarily to law enforcement, lawyers have filed 11 class actions and Vermont Attorney General TJ Donovan and the ACLU, represented by Jay Edelson of Edelson PC, have also filed lawsuits… The lawsuits allege that Clearview AI scrapes internet sites for publicly available images without the knowledge or consent of the individuals in the photographs and, at times, in violation of the rules of some social media sites, then sells access to the information to not just law enforcement but to retailers.”

The article indicates that Clearview AI has stated that it will argue a First Amendment defense because the photos are publicly available.

Law.com does a great job of outlining the issues around this case, and it is a good primer as we will likely continue to see an increasing number of cases around facial recognition technology.